by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

Brookline High Deleveling and its Discontents

For now, the fate of Brookline High’s 9th grade Honors English course has been decided.

After Thursday’s 7-2 vote by the School Committee, Honors English survives. The future is less certain for “deleveling” — the ambitious faculty-designed initiative to substitute non-leveled courses for several of the advanced offerings in the BHS catalog.

In this year’s ninth grade, 117 students — a fifth of all 9th graders — were recommended by 8th grade faculty for the first year of the “pilot” non-leveled English course. Thursday’s School Committee vote continues the pilot phase — but rejects expanding the pilot to cover all 9th graders. The decision leaves key questions unanswered:

Will the number of rising 8th graders who enroll in the pilot course grow or shrink?

How many enrollees are necessary for the pilot to be viable as an alternative to the “College Prep” (standard) and Honors level courses that will continue to be offered?

Regardless of raw numbers, given the School Committee’s continued support of the Honors offering, will classes in the deleveled pilot course achieve the oft-stated goal of “looking like the high school as a whole,” or skew more homogeneous over time?

In the pilot’s first year, 39% of black students are taking deleveled English, in contrast to 18% of Asian students and 19% of white students. High rates of Asian (69%) and White (66%) students opt for the Honors course, while Black students enroll at a 20% rate.

Looking Back: Deleveling Was Encouraged Prior to Hitting ‘Pause’

Anthony Meyer, the BHS Head of School, came to Thursday’s meeting armed with evidence that deleveling of courses has a record of School Committee blessing going back years.

2017: Superintendent Andrew Bott tasks principals to “review their processes to reduce disparities.”

2019: The launch of deleveled WHISP (World History: Identity, Status and Power).

2022: WHISP is reviewed by the School Committee.

Jan. 2023: The committee approves a deleveled 9th grade (“reimagining ninth grade”), beginning with an English course on a pilot basis.

Consistently, among BHS leadership and faculty, the expectation for deleveling initiatives was that, if successful in narrowing achievement gaps, they would evolve from pilot to permanent, and expand across other subject areas and then beyond the 9th grade level. Here are excerpts from an in depth article written by student reporters for BHS’s The Cypress in March of 2023:

“New pilot courses for world language and math are planned to be introduced in Fall 2024.”

“The science department is still in the preliminary stages of considering what an unleveled 9th grade physics class would look like.”

“The (World Languages) department is in the beginning stages of developing a new program and will potentially launch a 9th grade pilot in Fall 2024.”

“Social Studies Curriculum Coordinator Gary Shiffman said deleveling across all subjects will make social studies even more heterogeneous because of class scheduling… ‘When the other departments delevel, our job will be easier.’ ”

March 2023: A special report in the BHS student newspaper includes a timeline leading to “reimagined 9th grade” in 2025.

What Anthony Meyer Said

No wonder, then, that the BHS Head of School took the School Committee vote pausing the deleveled English pilot as a shock. His words:

“I understand the need for more information. I also own and understand some of the shortcomings in our process in terms of bringing along parents and guardians and caregivers.

“As you can hear in my voice I’m upset. I’m upset because I have a wonderful faculty that is trying to think about the best ways to serve all students, particularly those that need it most.

“I welcome energy, frustration, anger from parents who feel like they were blindsided by the work that we have been doing over the last several years. I have been concerned that in some of those organized communications the word moratorium was used over and over again… To me, it feels like killing equity work. And I know that’s not what you’re trying to do.

“I’m worried about the message that I’m carrying back to my faculty and staff about really important work that we need to do.”

Questioning Superintendent Guillory … And His Answer

The School Committee’s Mariah Nobrega was one of those who voted to tap the brakes on the expansion of the 9th grade deleveled English pilot. Prior to the vote, she questioned Superintendent of Schools Linus Guillory as to his position on the deleveling pilot and its future.

Mariah Nobrega: Do you mind answering where you stand on this?

Dr. Guillory: I do think that we still have some work to do around making sure that all of our students that are in these courses are actually getting the full benefit… not just looking at the 9th grade course but across our courses in general. Some of our marginalized students are still struggling. I do think we have an opportunity as a district to be a leader not only for Massachusetts but in the nation with the right supports. There’s still some more exploration … I’m intrigued by this notion of the earned honors… what opportunities lie there. I hope that’s helpful to your question.

Mariah Nobrega: So it sounds like you’re interested in exploring more data for this pilot. Is that accurate?

Dr. Guillory: Now that’s a harder one. I think the staff have made a compelling case to move forward. But I do also know that the real question is this notion of insuring that we have additional supports that may be required for students that we’ve not contemplated as yet. But I do think the team is committed to figuring that out… I would be committed to supporting them in their work moving this forward.

Mariah Nobrega: Thank you.

What’s at Stake

The step back from reimagining 9th grade (broadly eliminating Honors in favor of non-leveled courses) represents a major shift in Brookline’s dynamics of education policy setting.

Gaining Influence: Parents and students who argued that Honors courses are essential to fulfilling college ambitions. (Students were also persuasive in their complaints of lack of rigor that left them bored in their classes.)

Stepping Up: School committee members joining with parents who pushed back against further deleveling.

On Hold: The role of District leadership and school administrators and faculty as curriculum innovators in pursuit of equity.

Not Going Away: The persistent achievement gaps across Brookline High’s diverse student body. Example (as reported to DESE):

One final point on the challenge of academic achievement gaps: They are embedded well before 8th grade, as the School Committee’s Steven Ehrenberg pointed out in his preface to voting for a pause for more data in the deleveling effort:

“We’re definitely failing some Black and LatinX kids in eighth grade by not recommending them for Honors class where they should be recommended for Honors class. But that’s not where we’re failing our kids of color. We’re failing them in the early grades because 44 percent of our Black kids who are not low income are not reading at proficiency level in the third grade. Among the low income Hispanic kids that number rises to 60 percent. Those deficiencies compound over time so that by the time they get to eighth grade they’re carrying all that with them. There’s only so much that recommendation (to Honors) is going to mitigate at that point.”

Brookline.news and the Boston Globe are covering the possible elimination of 9th Grade Honors English as breaking news. However, the story has been an evolving one, with significant context beyond what is being reported. I first wrote about the roots of the proposed change in June of 2023. Here’s a reprint.

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

Is ‘Course Deleveling’ the way forward for BHS?

At their meeting on June 8, members of the School Committee offered praise and a send-off bouquet to the committee’s ‘22-’23 student representative, Alice MacGarvie Thompson, a graduating senior at BHS.

She proved her value one last time by offering an overview of a practice which she introduced as “the one thing I’d most want to change … The system of course leveling has been one of the most frustrating things about my time at BHS.”

She began with findings from an admittedly random survey that drew 56 responses from classmates. The survey tested their views on the courses they had taken while at BHS — either at the “standard” level, or at higher levels (“honors” and “advanced placement.”)

Note: the terms represent the level of difficulty of courses, and are presumed to correlate with the perceived ability/ achievement of those placed at each level.

How is the sorting of eighth graders into “leveled” classes in 9th grade determined? Alice cited several factors based on her survey:

teacher recommendations;

interest in the class;

“how much work the class would be;”

parent opinion;

perceived impact on college acceptance.

The result of Alice’s research as well as research by student journalists at The Cypress, BHS’s student newspaper, leaves little doubt as to the racial disparity resulting from ‘leveling’ placements decided by educators, students and parents.

Among eighth graders who will enter BHS in 2023:

only 6% of black 8th graders were recommended for advanced geometry;

30% were recommended for honors geometry;

while 64% were recommended for standard geometry.

The contrast with other demographic groups was made obvious in a chart included in Alice’s presentation (modified here for greater readability):

Ethnic/Racial Disparity In 9th Grade Math Levels

From The Cypress: “Brookline Moves to Delevel 9th Grade”

Alice summed up the message of the data:

“Black students are more likely to be placed in standard courses, while white students tend to be placed in honors and AP courses. In effect, leveling segregates BHS… If you were in the halls, you'd be shocked at how segregated BHS is because of this.”

The presentation led to a back-and-forth between the School Committee’s Mariah Nobrega and PSB Superintendent Linus Guillory:

Mariah Nobrega:

“I find this very troubling. These kids haven't even set foot in the high school. The data's right there. What are we doing to correct this before it sets a whole trajectory in place?”

(Once “leveled,” students tend to stay on the same track through all four grades at BHS.)

Dr. Guillory:

“Last year we took a look at this through course recommendations (by educators), and I believe this is where this is coming from. There's a whole body of work that has to interrupt these patterns; also, having parents understand what their roles and responsibilities are — not just to accept these (course) recommendations if they have concerns about them.”

“We've done some work to understand the bias in this, but also we're not going to just accept this and let it slide…

“I think what’s most striking is that students are performing well in math, but then are being referred to lower or standard classes. So those realities do exist.”

Mariah Nobrega:

“I don't want to let this go… There needs to be some sort of intervention here immediately… If this is what we get, then maybe the default is everyone goes into honors unless they are explicitly bumped up or bumped down… This doesn't work for me and it doesn't work for kids or anyone else in this room.”

Student Has The Last Word

The above exchange unfolded in the middle of Alice Thompson’s presentation. She eventually resumed her talk, explaining that pilot efforts at “deleveling” certain of the 9th grade courses are underway, but the path to extending the pilot to 10th grade and beyond remains uncertain. She summed up:

“I think we're avoiding the inherent issue here. Sorting students into these different levels and categories isn't really working. You can't tweak a policy or system that was designed to reproduce inequities, no matter how many programs you add or changes you make or bias trainings you do.

“I don't think leveling is good for BHS. I don't think it's good for any students. I don't think it's a good education policy to be constantly sorting students by perceived smartness and capability.”

Newton Confronts AP Exam Questions

Deleveling of Brookline High School courses, if that is the way forward, will not happen overnight, nor without questions being raised as to the impact on students competing for admission to top-ranked colleges.

That much seems to be the message of recent discussions of the school committee in Newton.

The results of an analysis of a study of “Advanced Placement Enrollment, Participation, and Exam Performance” were presented at a meeting on May 22. The study was undertaken to determine the impact of years of efforts to address past disparities by fostering enrollment in AP and other advanced courses that is “more representative of Newton’s student community.”

You can view slides from the presentation to the School Committee here, or read coverage by FigCityNews.com here.

The meeting replay is available on NewTV.

One of the outcomes pointed to by the study is that Newton’s AP scores at the highest level have declined somewhat in recent years. Here is a comparison of AP test outcomes, showing the percentage of students who achieved in the upper range of AP scoring (3-5 on a scale of 5):

Although Newton has experienced a decrease in students scoring at the highest levels on the AP exam, and an increase in students scoring at lower levels, the Newton study points out that expanded access to rigorous courses “has been shown to improve postsecondary outcomes for students regardless of exam score.”

I published my first edition of “All Politics is Local” in April of 2021. Today, over 1000 readers receive the free newsletter by email to stay informed of Brookline news and local issues. To join them, use the Sign Up feature on this page. — John VanScoyoc, Select Board

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

Override Flags Are Flying

Some will accuse me of being alarmist with the above headline. They have a point. As of now, I don’t know anyone from Town Hall who argues we will need yet another ballot question in 2024 like the one we had in May of 2023 — which added some $12 million to the tax levy over and above the 2.5% tax limit allowed by law.

To be clear, I voted for the 2023 Override because, as I saw it, the added tax revenues were needed to close the budget gap left behind by expiring COVID monies (CARES Act and American Rescue Plan Act on the Town side, and so-called ESSER funds on the School side).

We’ll benefit from that 2023 override in installments — a portion was applied to the FY24 budget that we’re operating under right now. Another portion will go towards the FY25 budget taking effect next July 1. A year later, the final share will apply to the FY26 budget. And that’s it.

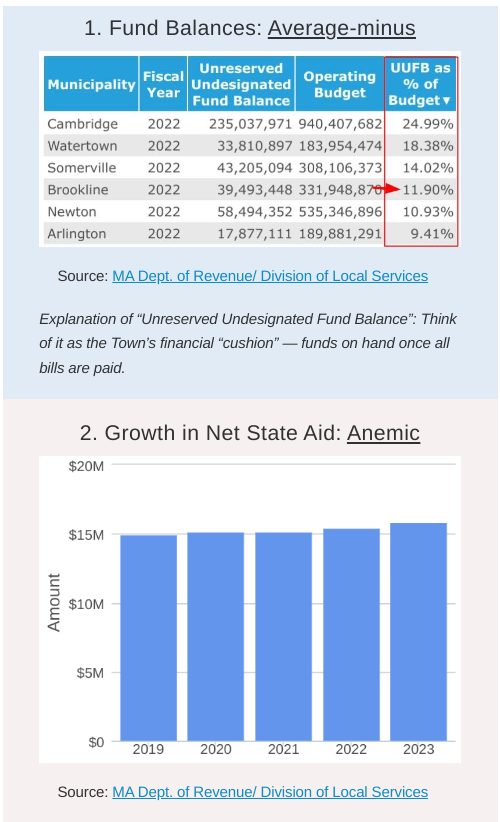

Let’s hope we manage to balance budgets beyond the next 30 months. If not, we’ll return to the familiar question of whether the pain of an override is preferable to the pain of layoffs and diminished services. Here are the trends that portend that reckoning:

Deputy Town Administrator Melissa Goff’s latest financial forecast. As an annual exercise, the forecast consistently projects growing deficits in the out years — even though such a future would be illegal. (Municipalities are required to balance budgets annually.) Nonetheless, it makes an important point: the state-mandated 2.5% cap on tax levy increases is insufficient to cover the known reality of inflation in labor agreements (approx. 4%), health care costs (6.4%), pensions (7.85%), and so-called OPEBS (post employment benefits other than pensions, inflating at roughly 5%).

From the financial forecast, here’s a chart making the point that the 2.5% cap on revenues is barely enough to cover annual pension and health care cost hikes, let alone any other budget increases.

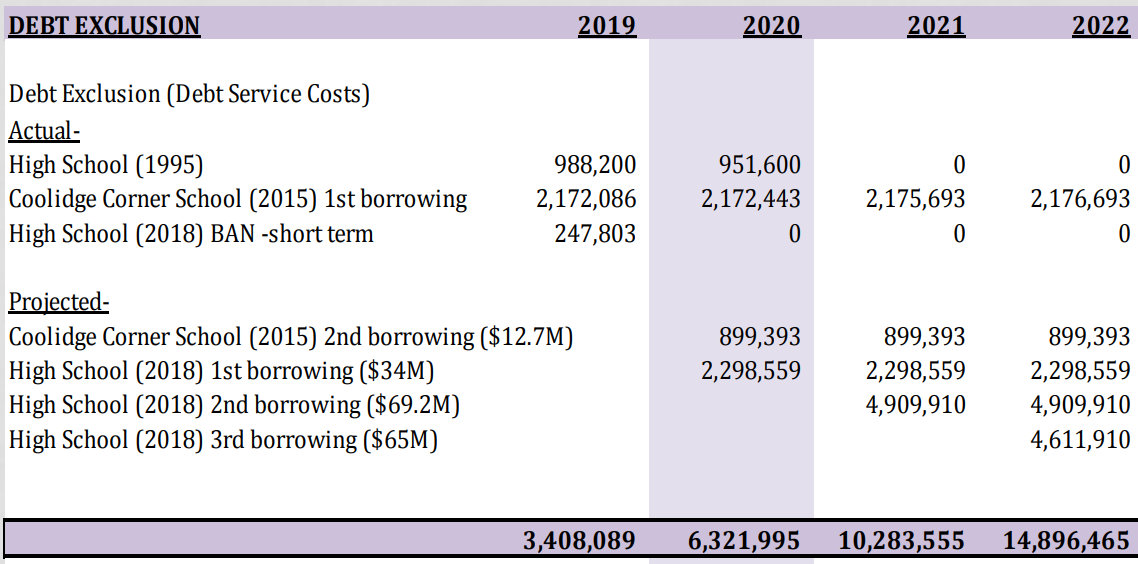

Debt Service is yet another annual expenditure that inflates at a rate in excess of 2.5%. These numbers from the financial forecast show the debt increasing by 51% over the next five years (an average annual rate of 10%).

Budget season is only just getting started. Between now and the Town Meeting that convenes at the end of May, we will no doubt see revenues and spending brought into balance. However, that is not true for now. The projected FY25 gap on the Town side is $581,000. On the School side, the gap is $1.1 million.

Finally, here is the chart showing the projected “structural deficit” over the next four years

When costs inflate faster than revenues, budget math is unforgiving — hence Brookline’s budget gap (above) that grows steadily through 2029. Equally unforgiving is the requirement that local budgets balance. Something has to give. How soon might we be compelled to choose between a tax cap override on the one hand, or layoffs combined with service cuts on the other? Neither hand is appealing. Would 2027 be too soon? Does anyone want to place a bet?

Not All Tax Burdens Are Equal

Single family homeowners will pay 9%-10% higher taxes starting in 2024. But condo owners' taxes will go down. It's a quirk of our way of funding local government. Does it have political consequences? That's the topic of my latest newsletter. Sign up at goodgovernmentforbrookline.com.

Education Catches a Cold — Brookline’s not Immune

Rates of absenteeism are causing alarm for state and local school officials. Many students who are farthest behind academically are missing out on 20% or more of school days. Brookline is not immune to the problem. More info is in my latest newsletter. Subscribe by using the Sign Up feature on this page.

Town Meeting has approved a package of rezoning measures that will add housing units to the mix of shops, services and offices lining Harvard Street. But how much housing? And how soon? Questions and answers are covered in my latest "All Politics" newsletter. Subscribe (free) using the Sign Up function on this page.

Housing like this is popping up on a sidestreet off Harvard Ave in neighboring Allston. What’s Braintree Street got that Brookline lacks? ANSWERS IN THIS WEEK’S NEWSLETTER. Sign up. (It’s free.)

All Politics is Local/ Sept. 28-Oct. 4

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

Using Google to Plan Harvard Street’s Future

Lately I’ve been visiting nearby retail areas via Google Streets — the app that enables you to take a visual tour of streetscapes past as well as present. It’s a useful tool, given Brookline’s focus on the future of Harvard Street.

In November, Town Meeting faces a vote on a form-based zoning plan, which is intended to encourage existing one-story commercial lots and blocks on Harvard Street to give way to multi-story buildings adding housing on second stories and above.

With that vote in mind, my Google Streets explorations have led to some conclusions regarding the mix of housing above/ stores below as a factor in the user-friendliness, neighborhood impacts and economic vitality of retail blocks.

Consider these examples:

Newbury Street

Newbury Street in the Back Bay is indisputably a lively area sought out by locals and tourists alike for the joys of shopping, dining and strolling. As such, it is also a successful example of the combination of housing above/ retail below. Here’s a typical block:

A class project by architecture students at MIT captured the next image, noting that the buildings on this block were originally residential on all levels; later, renovations converted the lower levels to commercial space. Clearly, the combination of retail below, topped by 3-4 floors (or more) of housing “works” for Newbury Street.

But what about the differences between Newbury Street and Harvard Street? There are several. Significantly, those Newbury blocks have alleyways like this one (behind the building to the left in the first photo).

Alleyways meet needs such as parking, trash storage and disposal, and delivery access.

Equally significant, they create space between the Newbury block and it’s rear neighbors. By contrast, one of the concerns of Harvard Street rezoning is rear setbacks: how much distance from adjacent properties is sufficient to allow for privacy, light and views?

Another difference: Newbury Street is one way, with less road space given to cars. It also lacks a bike lane. The tradeoff is generous allowance for curbside parking on both sides of the street. Equally ample are the sidewalk and patio spaces, leaving room for tree plantings. This, combined with the stoop setbacks of many buildings, creates an open air feeling as you stroll.

2. Washington Street, Brighton Center

The feeling is quite different when the advantages of Newbury Street are absent. This block of Washington Street in Brighton Center makes the point:

The combined effect of narrow sidewalks, no trees, and multi-story residential-over-retail buildings dwarfs and crowds pedestrians, while cutting off visibility of storefronts to passing cars. Two-way car lanes are wider. The combined car and bike lanes make pavement the dominant theme, and threaten to strand pedestrians who dare to cross at midblock.

3. Washington Street, Newton

Demolition and rebuilding can add housing to a commercial street, but multi-story residential-over-retail complexes aren’t guaranteed to enliven the streetscape.

Washington Street in Newton presents many challenges. The lengthy stretch between Newton Corner and West Newton is hemmed in by the Turnpike, while the active side of the street is divided between commercial and non-commercial uses, with one significant pocket dominated by a suburban-style shopping experience (generous parking in front, stores at back).

The Walnut Street corner offered, to the north, a beloved restaurant, Karoun, that thrived for 40 years but closed in 2017. The entire block was then developed into 140 apartments, including 21 affordable and 14 middle-income. The result, including street level retail space, was an architectural refresh — nonetheless, the resulting streetscape can best be described as monotonous, given the repetitious (x3, hence “Trio”) building components. Judge for yourself:

4. Improving on Single Story Retail

Not far from the Trio development in Newton is a retail block that demonstrates how even modest single-story strips can contribute to improved streetscapes. This is on Walnut Street:

Widened, repaved sidewalks, planters and window boxes, historically appropriate lamp posts, a bench, awnings, sculpted trim surrounding unique, non-generic signage — all the small details combining to good effect in an otherwise basic building that is compatible with the adjacent neighborhood.

Some obvious conclusions come to mind where Harvard Street is concerned:

Yes, single story retail blocks, as such, don’t contribute to housing supply. But they survive because they “work” for the current tenants and owners.

Some areas of multi-story housing-above-retail work better than others as the basis of retail districts. (Newbury Street vs. portions of Washington Street in Brighton, for example.)

Legacy buildings can be made fresh and lively; brand new construction can be generic and deadening. (The reverse is also true.) Design matters.

Increased housing is a worthy goal. But so is compatibility with adjacent neighborhoods. And so is continuity for retail businesses that are comfortable — and prospering — on the Harvard Street of today.

Come November, Town Meeting Members have the future of Harvard Street in their hands.

All Politics is Local/ Sept. 20-27

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

The Pierce Demolition Predicament

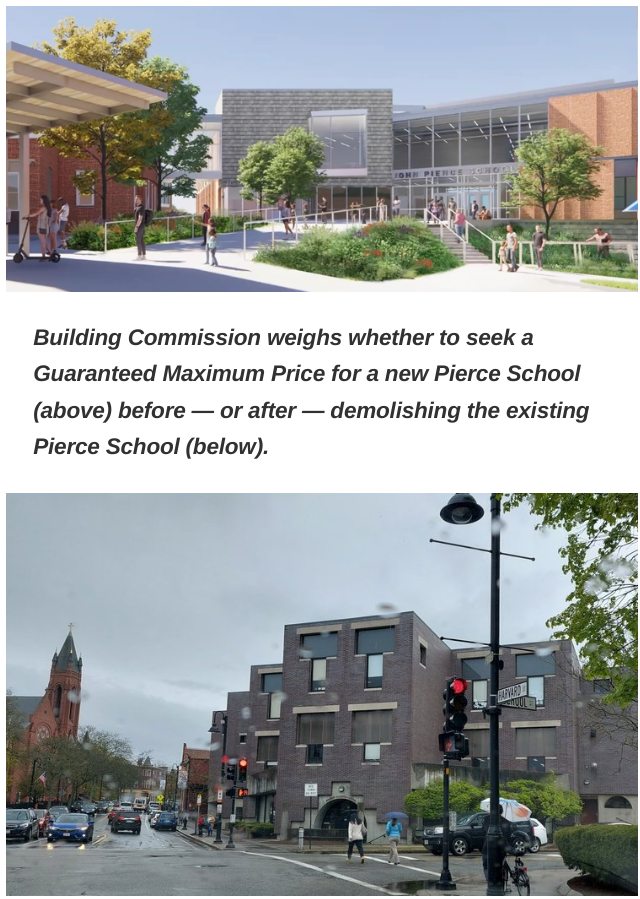

Town and School officials face a consequential decision about the next steps in the Pierce School project. Put simply, the decision requires weighing these unknowns and risks:

Would early demolition of the existing Pierce School (1970s building) yield information about what lies beneath the building that would materially improve the final design of the new school — possibly avoiding costly “change orders” during construction?

Alternatively, does recent construction cost inflation (as well as lessons learned from the Brookline High project) signal that demolition of Pierce in the absence of a Guaranteed Maximum Price (GMP) carries significant financial risk?

To state the obvious: if officials decide in favor of demolition first/ Guaranteed Maximum Price later, there is no turning back.

If the GMP significantly exceeds the already-approved borrowing of $212 million for the project (partly state reimburseable), two scenarios are possible:

Absorb the Guaranteed Maximum Price through cutbacks in the project — in effect delivering less than was promised when voters approved borrowing.

Go back to the ballot and Town Meeting for an increase in the budget for the project and the excluded debt (repaid via a further bump in property taxes).

If early demolition is approved, the goal would be “substantial completion” of the new Pierce School by Oct. 29 of 2027.

If holding out for a Guaranteed Maximum Price is approved, then the project will be delayed accordingly, according to the School Committee’s consultant on the project.

School Committee Questions

Helen Charlupski is the School Committee’s most senior member. She plays a major part in meetings of the Pierce Building Committee. She also monitors the Town’s Building Commission, which will meet Oct. 10 to discuss the Pierce options further (for a third time) and, likely, make a decision.

Here is some back and forth from last week’s School Committee meeting, prompted by Helen Charlupski’s report on the Pierce options:

David Pearlman (chair): Would the bidding process (for construction) be completed prior to full demolition?

Charlupski: No.

Pearlman: I’m just a bit concerned about demolishing a building before we have bids.

Charlupski: That’s exactly what the Building Commission talked about and there will be a letter — the project manager is putting it together with the contractor — of why this is necessary. It will save us money in the long run to have demolition done first.

Steven Ehrenberg — I understand what you’re saying but it’s also a potential risk, isn’t it?

Charlupski — Well, it is and it isn’t. It’s not a building we want to keep the kids in, and we do have the old Lincoln School… We know we have money to build a new school and we will keep within that budget.

Pearlman — How can you really know that, though, if we don’t have the bidding completed prior to demolition? How do we know it’s within budget?

Charlupski — The benefit risk is in our favor to take the building down, see what’s there, and during that process have the architect do the design that takes into account whatever needs to happen.

Building Commission seeks more info

The Building Commission has twice postponed voting on the Pierce “demolish first/ price later” approach, opting instead, to seek a full explanation, in writing, from the project consultant (Left Field) as to their recommendation. That information is now promised for the Oct. 10 meeting.

At the Sept. 12 meeting, Commission Chair George Cole offered this comment:

“As I explained last meeting, we proceeded with early release packages for the high school, and we were in a situation where we had released a lot of work without knowing the final cost. The final cost came in above budget, and we were kind of stuck.”

All Politics is Local/ Special Edition

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

18 Approved Projects,

1325 Units of Housing

Brookline government is working full tilt to come up with rezoning plans aimed at increasing housing production to meet a state mandate. What seems to go ignored is that, waiting in the wings is a wave of some 1325 units of housing construction already planned and approved.

Well before the legislature imposed the mandate of the MBTA Communities Act, the 18 projects shown in the table below were conceived, reviewed, and given the go-ahead by our planning and zoning officials — with the expectation that they will come online before 2027 at the latest.

(The italicized date under each represents certificate of occupancy. I cite the data for 3-bedroom units because those are key to attracting families. HV= Hancock Village. ROSB= Residences of South Brookline.)

The next wave of added housing units

The total of units in the pipeline is 1325. That’s a lot of new construction. The number of 3-bedroom units is 154 — potentially impacting school enrollments.

In a few cases — such as the Brookline Housing Authority development on Marion Street — some new units replace demolished units. Most of the unit numbers under the photos represent a net gain in housing.

Ten of the planned developments are so-called Chapter 40B projects, within which at least 20% of the units are set aside for income-qualified tenants (or owners).

Ten of the developments are in the Harvard Street/Coolidge Corner area. Three are tied to Hancock Village. Two are on Boylston Street west of Reservoir Road.

‘Safe Harbor’ Comes and Goes

My inspiration for tallying all the approved-but-not-yet-built projects is a spreadsheet that Planning Director Kara Brewton recently shared during a meeting with the Housing Advisory Board.

The purpose of the spreadsheet is to track recently approved housing including subsidized units, in order to anticipate any periods when subsidized units fall below 10% of the Town’s total housing.

Should the so-called Subsidized Housing Inventory (SHI) number fall below 10%, Brookline loses its “safe harbor” status.

Brookline’s loss of safe harbor status permits developers, under Chapt. 40B, to exceed local density limits by seeking “comprehensive permits” from the state — effectively short-circuiting Brookline’s zoning authority.

Here are the numbers from Kara Brewton’s spreadsheet that point to the upcoming three-month period (Sept. - Nov.) when Brookline will lose safe harbor status by falling below the 10% SHI threshhold.

(The above percentages assume the 2020 Census count of 27,742 housing units. Kara Brewton’s explanation of the factors that cause the count of Brookline’s SHI units to fluctuate over time is on this video, beginning at 1:44:22.)

Sneak Preview in Chestnut Hill

With the Town’s approaching loss of safe harbor status, a new Chapt. 40B proposal debuted just two weeks ago for a 96-unit development off Hammond Street in Chestnut Hill — in the block bordered by Sheafe Street and Heath Street.

Charles River Realty’s proposed Chapt. 40B development at 621 Hammond St. will replace traditional 2-3 family housing and the Hynes auto repair business on a portion of Sheafe Street. The plan calls for 96 rental units (55 1-BR, 30 2-BR, and 11 3-BR). Twenty-five percent of the units will be set-aside for income-qualified tenants.

Ahead: How Many 40B Applications?

Kara Brewton’s overview of Brookline’s temporary change of Chapt. 40B eligibility status ended with this estimate of what’s ahead:

“So we're likely going to get three or four, maybe even six new 40B applications this fall… That's the way these things roll when we pop back under that ten percent.”

Worth Noting

The timing of the temporary '“safe harbor” lapse coincides with the approach of controversial Town Meeting votes aimed at rezoning Harvard Street and/or loosening the Town’s zoning in multi-family districts in North Brookline.

Debate among Town Meeting Members as to Brookline’s path to compliance with state housing production mandates is already fraught — and perhaps will intensify in the days ahead.

All Politics is Local: June 30 - July 7

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

Is Brookline Done With Looking Up?

I’m taking a risk by asking a question that lately hasn’t been on the table for discussion in Brookline: Are we done with tall buildings?

And, yes, I’m aware that the hotel and residences planned for the Waldo Durgin site will be tall — as will 83 Longwood and the building planned for the Neena’s (lighting store) site adjacent to Trader Joe’s.

The above building plans were hatched prior to Covid 19. Ground-breakings haven’t yet been scheduled — meanwhile, Greater Boston is in a period of malaise for large construction projects.

Recently, nothing of the scale of the above high-rises has been added to the pipeline for review by Brookline planners. What’s also notable is that projects such as the above — tall by Brookline standards — are modest compared to the height limits set for projects in nearby Somerville and Cambridge.

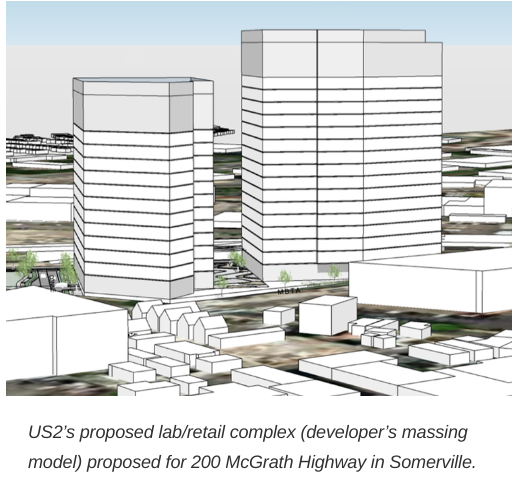

Consider the example of a building attracting much attention — and some controversy — in Somerville. This is what “transit-oriented development” looks like in that nearby city.

The development is known as USQ (Union Square). The tower building offers 450 housing units, of which 90 are “permanently affordable across three income tiers.” The developer, US2, will contribute $1.5 million to the city’s affordable housing trust.

Opinion is divided as to whether Somerville got a good deal by combining massive height and scale with required affordable housing minimums. Defenders of the tower argue that 90 affordable units is a big number, and that the total of 450 units added to supply will also benefit affordability in the long run. Critics focus on the luxury pricing of many of the market rate units (rents of $5,000+) and the hundreds of parking spaces included in the combined lab/office/retail/housing complex bringing more cars to the area.

US2 isn’t done with major development in Somerville. Here is a model (massing only) of their proposed lab/retail complex in the city’s Brickbottom neighborhood.

The only comparable proposal experienced in Brookline is Bulfinch Companies’ vision of lab development at 10 Brookline Place (site currently occupied by Dana-Farber offices). Early models aroused opposition from some Brookline Village neighbors. Late in 2022, the work of the 10 Brookline Place Study Committee was suspended “In the absence of an imminent project and given the uncertainty of any redevelopment project timeline due to the long-term lease of 10 Brookline Place’s current tenant.”

Cambridge’s Ambitious Affordable Housing Overlay

Cambridge’s City Council is divided into two factions — both offering ambitious expansions of the City’s Affordable Housing Overlay, but with differences as to maximum heights.

One faction proposes allowing 100-percent-affordable buildings to rise to 25 stories in some of the city’s squares (Harvard, Central, etc.), while allowed heights would increase to nine stories where the limit currently is six, and up to 13 stories where the limit currently is seven.

The other faction on the Council countered with a proposal to allow 100-percent-affordable buildings to rise to 12 stories along the city’s main corridors (such as parts of Mass. Ave.) and to 15 stories in the squares.

The result of the maneuvering on the Council suggests that a final vote on the matter will be delayed until the fall — perhaps postponing the issue until after the city’s next municipal election.

(Cambridge Day is an excellent source for coverage of this story. Each report has a convenient “next” and “previous” tab so that you can follow all of the coverage over several weeks, if you wish.)

Meanwhile, in Brookline …

In 2022, Town Meeting approved a measure creating an Affordable Housing Overlay study. The town’s Housing Advisory Board responded by designating an Affordable Housing Overlay Subcommittee. They are hard at work — including learning from the AHO processes in Cambridge and Somerville. You will find minutes of their meetings here and a recent Power Point overview of zoning’s impact on housing patterns here.

Will the end result of their work have an impact on allowable building heights under Brookline’s zoning code? It’s too soon to tell. (But it’s never too soon to stay informed.)

All Politics is Local: June 23 - June 30

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

Our Underappreciated Building Commission

With no business to conduct, but just to stay informed, I observed the most recent meeting of the town’s Building Commission. I don’t know anyone else who can make that claim.

Other than the commissioners themselves and the various parties behind items on the agenda, that’s how it usually is. The Building Commission toils in obscurity, despite being arguably one of the most important and productive public bodies in the Town.

No one gets appointed to the Building Commission on a whim. The members — all top professionals in their fields — include an architect, a real estate developer, a business attorney, a builder, and an engineer.

The commission meets monthly (plus added special meetings) in order to oversee all of the Building Department’s major construction projects. In 2022 alone, that meant keeping tabs on:

exterior improvements to Fire Station 4, the Larz Anderson comfort station, the public safety building, the main library, and Soule recreation center;

finishing touches to the new 22 Tappan building, Tappan gym and STEM wing of the high school, as well as Cypress playground;

year two of construction of the new Driscoll School;

schematic design of the proposed new Pierce School;

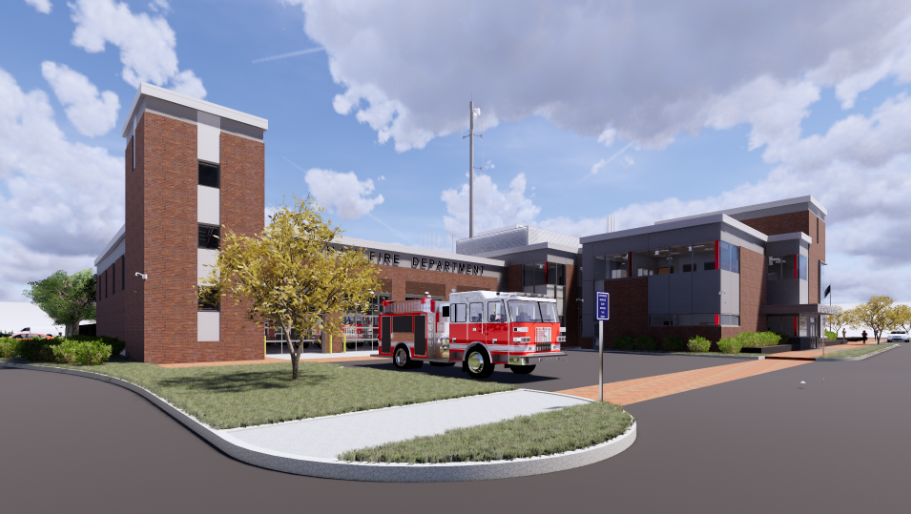

the launch of planned renovations (and one demolition/new building) at the town’s fire stations.

This is an unprecedented scale of construction for the Commission to monitor and approve — amounting to more than $500 million worth of projects.

Adding to the Commission’s burdens, they have lost — or will lose — several mainstays of the Building Department who have been trusted partners over dozens of projects. Ray Masak left a year ago as the high school construction was winding down. Matt Gillis, who has been keeping an eye on the Driscoll project, bid farewell at last week’s Commission meeting. (He’s been hired as Director of Finance for the Natick Public Schools.) Building Dept. Project Manager Tony Guigli called Gillis “a big loss to the town” — and then reminded the Commission that he himself is dialing back to half time. Which led to this back and forth:

Guigli (referring to the need to incorporate geothermal heat and cooling to the fire stations): “The problem is, things are not getting less complicated —they’re getting more complicated.”

Commissioner George Cole: “And we just added a very complicated $215 million project to our docket.”

Commissioner Janet Fierman: “And the more poorly staffed we are the more complicated it gets. And the more expensive it gets. That’s the reality.”

Driscoll Deadline: A Moving Target

Speaking of “the more complicated it gets,” there’s the new Driscoll School rising on Washington Street. Hopes have been abandoned for doors to open at the start of the new school year in September. The revised deadline is early October — and even that seems shaky. Witness these comments from the Building Commission meeting:

Commissioner George Cole: “I walked the job last week and I was deeply disturbed by what I saw. I walk a lot of construction projects… Why isn’t roof flashing done? On every facade there are little bits and pieces of every window incomplete. It just shows a total lack of coordination and sequencing. That exterior should be done. You should be starting to clean up that site. And it’s a mess. And on the inside little bits and pieces of every room are incomplete. I was really dismayed. There is a ton of work to be done over the next three months.”

Commissioner Nathan Peck: “I’d echo that. Every elevation had hundreds of parts and pieces missing.”

The meeting got off to an uncomfortable start when Nathan Burnham of Gilbane (the Driscoll building contractor) informed the Commission that both Gilbane’s General Superintendent on the Driscoll job and the Mechanical Electrical and Plumbing Superintendent had departed to take jobs elsewhere.

Commissioner Janet Fierman: “We’re on our third superintendent. The staff turnover is not good for the job. It’s not good for the town. And it’s not good for getting it done… I don’t want to be told that we should be paying more money for an extended schedule because our construction manager has staffing problems.”

Commissioner George Cole: “Is this typical of a Gilbane job?”

Burnham (Gilbane): “I’d consider it unprecedented. I’ve never been involved in a project that had this happen.”

Commissioner Fierman: “Is it happening on other jobs?”

Burnham: “That’s a great and important question… It certainly is a challenging project… My general reaction is the last three years in the construction business have been quite stressful. People are burnt out. They’re looking for other opportunities that perhaps present better life-work balance.”

The Problem With Ceilings

As the meeting unfolded, it emerged that delayed completion of ceilings after “ceiling-related changes” contributed to slowdown of the Driscoll project, cascading to all the other work that hinges on inspection of completed ceilings.

Adam Keane (from Leftfield/ Owner’s Project Manager): “The reflective ceiling plans in this building are random… We have ceilings that are on different planes… They’re ACT clouds that change planes — almost undulate down the hall. They’re very complicated, very precise. It took a while to coordinate them.”

Commissioner Fierman: “What I hear loud and clear is that it is the belief of the contractor, the architect, and the project manager that the job must have another ten days… That’s reality. What I’m not willing to do is for the town to incur any additional cost. Because it’s not the owner’s (the town’s) cost.”

Jim Rogers (from Leftfield/ Owner’s Project Manager): “In theory, I can get close to no cost change (for an extension to 10/6 for project completion)… 10/6 works for the best orderly move-in possible for the schools.”

Fierman then made the same pitch (that there should be no additional cost to the town from the Driscoll delay) to the representative of the architect.

His response: “I hear you loud and clear. We’ll take it back to the boys, and we’ll talk about it.”

Judge for yourself if “in theory” and “we’ll talk about it” are cost-saving commitments the town can put money on. And stay tuned to meetings of the Building Commission. They know their business.

Ceiling images from the architect’s fly-through animation depicting interior design of the new Driscoll School.

All Politics is Local: June 16 - June 23

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

Is ‘Course Deleveling’ the Way Forward for BHS?

At their meeting on June 8, members of the School Committee offered praise and a send-off bouquet to the committee’s ‘22-’23 student representative, Alice MacGarvie Thompson, a graduating senior at BHS.

She proved her value one last time by offering an overview of a practice which she introduced as “the one thing I’d most want to change … The system of course leveling has been one of the most frustrating things about my time at BHS.”

She began with findings from an admittedly random survey that drew 56 responses from classmates. The survey tested their views on the courses they had taken while at BHS — either at the “standard” level, or at higher levels (“honors” and “advanced placement.”)

Note: the terms represent the level of difficulty of courses, and are presumed to correlate with the perceived ability/ achievement of those placed at each level.

How is the sorting of eighth graders into “leveled” classes in 9th grade determined? Alice cited several factors based on her survey:

teacher recommendations;

interest in the class;

“how much work the class would be;”

parent opinion;

perceived impact on college acceptance.

The result of Alice’s research as well as research by student journalists at The Cypress, BHS’s student newspaper, leaves little doubt as to the racial disparity resulting from ‘leveling’ placements decided by educators, students and parents.

Among eighth graders who will enter BHS in 2023:

only 6% of black 8th graders were recommended for advanced geometry;

30% were recommended for honors geometry;

while 64% were recommended for standard geometry.

The contrast with other demographic groups was made obvious in a chart included in Alice’s presentation (modified here for greater readability):

Ethnic/Racial Disparity In 9th Grade Math Levels

From The Cypress: “Brookline Moves to Delevel 9th Grade”

Alice summed up the message of the data:

“Black students are more likely to be placed in standard courses, while white students tend to be placed in honors and AP courses. In effect, leveling segregates BHS… If you were in the halls, you'd be shocked at how segregated BHS is because of this.”

The presentation led to a back-and-forth between the School Committee’s Mariah Nobrega and PSB Superintendent Linus Guillory:

Mariah Nobrega:

“I find this very troubling. These kids haven't even set foot in the high school. The data's right there. What are we doing to correct this before it sets a whole trajectory in place?”

(Once “leveled,” students tend to stay on the same track through all four grades at BHS.)

Dr. Guillory:

“Last year we took a look at this through course recommendations (by educators), and I believe this is where this is coming from. There's a whole body of work that has to interrupt these patterns; also, having parents understand what their roles and responsibilities are — not just to accept these (course) recommendations if they have concerns about them.”

“We've done some work to understand the bias in this, but also we're not going to just accept this and let it slide…

“I think what’s most striking is that students are performing well in math, but then are being referred to lower or standard classes. So those realities do exist.”

Mariah Nobrega:

“I don't want to let this go… There needs to be some sort of intervention here immediately… If this is what we get, then maybe the default is everyone goes into honors unless they are explicitly bumped up or bumped down… This doesn't work for me and it doesn't work for kids or anyone else in this room.”

Student Has The Last Word

The above exchange unfolded in the middle of Alice Thompson’s presentation. She eventually resumed her talk, explaining that pilot efforts at “deleveling” certain of the 9th grade courses are underway, but the path to extending the pilot to 10th grade and beyond remains uncertain. She summed up:

“I think we're avoiding the inherent issue here. Sorting students into these different levels and categories isn't really working. You can't tweak a policy or system that was designed to reproduce inequities, no matter how many programs you add or changes you make or bias trainings you do.

“I don't think leveling is good for BHS. I don't think it's good for any students. I don't think it's a good education policy to be constantly sorting students by perceived smartness and capability.”

Newton Confronts AP Exam Questions

Deleveling of Brookline High School courses, if that is the way forward, will not happen overnight, nor without questions being raised as to the impact on students competing for admission to top-ranked colleges.

That much seems to be the message of recent discussions of the school committee in Newton.

The results of an analysis of a study of “Advanced Placement Enrollment, Participation, and Exam Performance” were presented at a meeting on May 22. The study was undertaken to determine the impact of years of efforts to address past disparities by fostering enrollment in AP and other advanced courses that is “more representative of Newton’s student community.”

You can view slides from the presentation to the School Committee here, or read coverage by FigCityNews.com here.

The meeting replay is available on NewTV.

One of the outcomes pointed to by the study is that Newton’s AP scores at the highest level have declined somewhat in recent years. Here is a comparison of AP test outcomes, showing the percentage of students who achieved in the upper range of AP scoring (3-5 on a scale of 5):

Although Newton has experienced a decrease in students scoring at the highest levels on the AP exam, and an increase in students scoring at lower levels, the Newton study points out that expanded access to rigorous courses “has been shown to improve postsecondary outcomes for students regardless of exam score.”

All Politics is Local: June 9 - June 16

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

How Higher Real Estate Taxes Impact Condo Owners

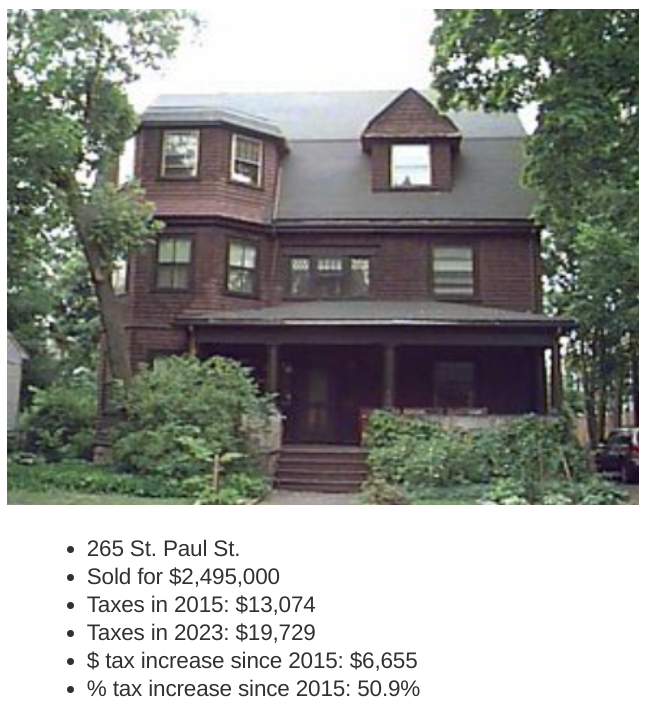

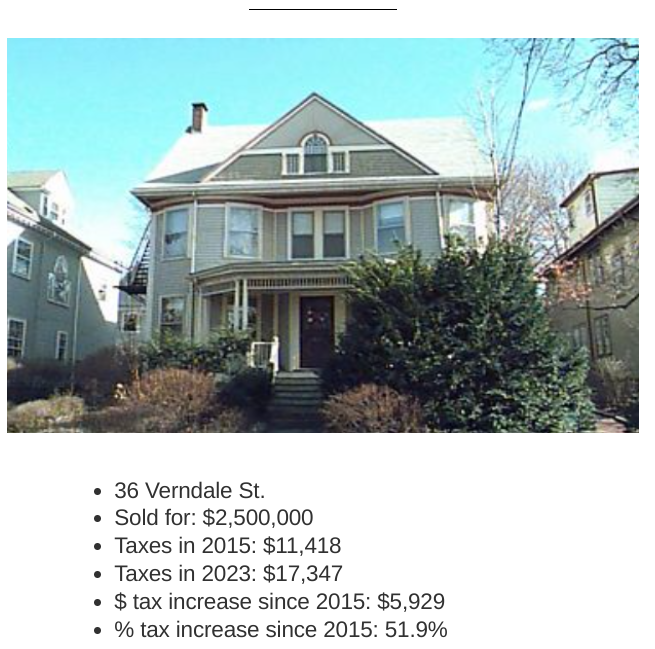

Last week’s “Tale of Three Houses” looked at the trend in real estate taxes through examples of three houses chosen at random from the latest Town Assessor list of real estate sales. For two of the houses, the eight-year increase in taxes (2015-2023) was 51-52 percent, while the third house saw taxes increase 32 percent.

One reader sent me the suggestion: Why not take a similar look at taxes on condos?

Hence the information that follows. The methodology was much the same, except that this time my source was the Assessor’s spreadsheet of the most recent year of condo sales. Condos significantly outpace single family homes in the number sold each year. For that reason, and because there is also greater variation in the pricing and taxing of condos, I chose to go with a representative group of ten condo sales (vs. the three single family homes profiled last week).

The highest price on the Assessor’s list of 550+ sales is a luxury condo on Seaver Street that went for 8.1 million dollars. The least expensive is a 300 sq. ft. unit on Beacon Street that went for $350,000.

To come up with my list of ten, I chose randomly (spaced 50 apart on the list, starting at 25th from the top) from high, middle and low price ranges. Here is the result, ranked from highest tax paid to lowest tax paid. The right hand column shows the percentage increase in tax bills over the eight year period.

Some observations:

Condos that are comparable in their sales prices sometimes are comparable in the assessed real estate taxes, but not always. Note several examples on the list of condos that rank higher than others in sales prices, but lower in taxes.

There is a wide range in the eight-year tax increase impacts, from a low of 22% to a high of 101%.

Despite the greater variability, nonetheless the average increase in condominium taxes over the eight year period (56%) is the same as the average single family (sf) home tax increase in that same period. (FY15 = $13,610 av. sf tax; FY23 = $21,322 av. sf tax. Increase over eight years = 56.6%.)

Clearing Up A Misconception

The number one misconception among reader responses to last week’s newsletter has to do with the cause of increased real estate taxes. Several readers pointed out that property values have also increased in the 50+ percent range over the 2018-2023 period, which they argued explains the 50+ percent average tax increases.

But it doesn’t.

Town Meeting Member Stanley Spiegel made the point very clearly in a Facebook discussion prompted by the “Tale of Three Houses”:

“If everyone’s assessed value were to double, everyone’s tax bill would rise by only 2.5 percent. If everyone’s assessed value were to drop by half, everyone’s tax bill would also rise by 2.5 present. That’s how Proposition 2.5 works.”

He’s referring to the state law that caps increases in tax levies at 2.5% annually regardless of increases in overall assessed values of real estate.

Now Do the Math

In raising awareness of the eight-year increase in real estate taxes, my purpose has been to broaden our future conversations when it comes to Prop 2 1/2 overrides and debt exclusions.

The assumption that owners of high-value properties should have no problem shouldering annual property tax increases in excess of 2.5% ignores the “ability to pay” factor — which is tied to incomes, not “wealth” derived from hot real estate markets.

However, it is also true, as some readers pointed out, that the eight year/ 56% increase in taxes is only partly due to overrides and debt exclusions. A portion of that 56% would be experienced regardless of ballot questions, because of the allowed 2.5% annual increase. Here’s a chart that shows the difference between recent tax increases allowable under Prop 2 1/2, versus the tax increases attributable to overrides and debt exclusions:

Conclusion: Over the past five years, the increase in real estate taxes due to overrides and debt exclusions has been greater than the allowable 2.5% increase by a multiple of 2.6 ($79 million vs. $30 million).

Inflation and Taxes: A Reader Responds

I’m grateful to Fred Perry of Precinct 3 for responding to the “Tale of Three Houses” by adding this context:

Forty-five percent (the average tax increase since 2015 on the three houses) sounds like a big number, BUT eight years is a long time. The Consumer Price Index part of it applies both to income as well as to costs, and REAL income over any period of time exceeds inflation by a small amount. That is why the population as a whole is generally richer over time.

Bottom line is that for the population as a whole, taxes going up at a rate equal to the rate of inflation + 1.6% is going to net out as something close to a break-even situation: Real Estate taxes went up but income went up by a similar percentage.

Where this is not so true and where there is therefore a squeeze on the taxpayer is if he is on the low-income end, where real wages have failed to keep up with inflation for years. That’s probably not the guy with the $2 million house, it is the renter, who sees rent increases passed on to him by the owner.

The renter is more likely to be low income while the owner of the rental unit tends to be a higher income type whose income has risen faster than inflation. So there are winners and losers but 45 percent is not the number to look at. The number to look at is how the change compares to real income for the effected parties.

I weep not for the guy who has a large asset which is not ‘liquid’ because he can solve that problem a lot of ways with financial advice. But the guy whose rent went up and who has the usual assets of those guys on the trash truck, he or she may be stretched.

All Politics is Local: June 2 - June 9

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

I went looking for a microcosm that would help to explain the close margin of the May 2 vote on the Pierce School project. I may have found it in the Assessors’ latest table of property sales.

You can check out the table yourself at the Assessors’ page on the town website. That’s where you will find this spreadsheet. It lists 204 property sales from 2021/2022. Roughly two-thirds of the properties are single family. The others are two- and three-family. The sales prices range from $540,000 for a house on Franklin Court to $10,800,000 for a property on Woodland Road.

The average price of the 204 sales comes to $2,502,740. With that in mind, I focused on the sales that fell between $2,400,000 and $2,600,000. From that subgroup, I chose three properties that seemed representative of the list as a whole. Here they are, with some added information comparing the property taxes of today to the taxes paid by the owner in 2015, eight years ago.

The average tax increase since 2015 on the above three properties is 45%.

Information about the demographics of the prior owners of the properties is available on the Street List of Persons kept by the Town Clerk. One of the owners was age 90+ and passed away prior to the sale of the property. Another was age 80+ and the third was age 75+.

Holding onto one’s house after retirement is a widespread situation in Brookline. So is living on an income that is “fixed” (limited to personal savings and pension or Social Security).

The pressure on elderly homeowners to keep up with the cost of living is such that the Assessors are currently reviewing guidelines that would enable a qualifying few to get tax breaks under a plan initiated by the Town’s Committee on Elderly Tax Relief.

The funds available for the program are limited. Inevitably, the number of participants will have to be small if the relief is to make an impact in individual situations. Or the grants will have to be small if the number of applicants is above expectations.

Surveying the demographics and income profiles of Brookline’s homeowning population would be useful in the event of future tax overrides and debt exclusions.

That the “No” vote on Pierce was highest in homeowner precincts is a fact. The trend of 45% increases in taxes over eight years, combined with data on fixed-income households, might help to explain why.

Note: The above analysis makes no assumptions as to how the owners of the above properties (past and current) might have voted on the Pierce question — or if they voted. The only assumption is that taxpayer sentiment plays a part in decision-making for and against overrides and debt exclusions. Evidence of ability to pay has traditionally been one of the questions investigated when Override Study Committees are appointed prior to ballot questions enabling increased taxes. No such committee was appointed prior to the vote on Pierce.

2022 Annual Report: A Selective Reading

The Brookline Annual Report for 2022 arrived just in time for our Town Meeting, which continues this week. Printed copies are scarce compared to prior years. Fortunately, a pdf version is available on the Town website.

It’s well worthy skimming — and perhaps reading in full, depending on your level of interest in the machinery that makes Town Hall hum.

I did my own random reading this past week, and gleaned these Top 20 Annual Report Factoids:

Brookline has a Fence Viewer, Inspector of Animals, Keeper of the Lock-Up, Local Moth Superintendent, and a Right to Know Coordinator. Who knew? (See p. 8.) The Inspector of Animals and Local Moth Superintendent are one and the same person.

The year produced a bumper crop of top staff who are new to Brookline: Chas Carey, Charles Young, Tyler Belisle-Toler, Lincoln Heinman, Joseph Callanan, Sigalle Reiss, and Amanda Hirst. Pop quiz: identify the positions they occupy. (Answers on p. 12.)

Chas Carey is Brookline’s fifth Town Administrator since 1943. Can you name the others? (p. 21)

Vital Statistics: Marriage intentions — 294. Marriages — 278. Births — 470. Deaths — 290. Licensed Dogs — 2,377. I went back ten years to track the births/deaths trend over time.

5. Voter turnout was 17.9% for the Town Election (redistricting year), 27.8% for the State Primary (including Vitolo vs. Fernandez), and 51.8% for the State Final (Healey vs. Diehl and Congressional contests). (p. 28-29)

6. Registered Democrats number 18,403. Republicans, 1,764. Unenrolled (“independent”), 20,539. The ten-year trend shows gradual erosion of (D) and (R) party registrants, while Unenrolleds have taken the lead.

7. The Police and Fire sections of the annual report (p. 34-51) are by far the most data-rich. See for yourself the records as to crimes, arrests, interrogations, warrants served, and more. There’s even a table of all the calls to the animal control division.

8. Despite their notoriety, turkeys cause fewer complaints than bats, coyotes and dogs. (p. 43)

9. Motor vehicles were involved in 37 crashes with bikes and 33 crashes with pedestrians. By far the most motor vehicle crashes were with other motor vehicles: 1,076. (p. 44)

10. 4,432 of the 9,074 calls to the Fire Department were for medical emergencies. Firefighters extinguished 22 structure fires in commercial and mercantile occupancies, multifamily homes, high-rise buildings, and single-family homes. (p. 47)

11. The Building Department’s activities included reviewing, permitting and inspecting over 250 tents and 50 bleachers for the U.S. Open Golf Tournament.

12. In total, there are 91 buildings (approximately 2.9 million sq. ft. of space) serving Town and School departments. (p. 53)

13. The BrookOnLine tool for direct reporting of potholes and the like generated 5,596 notifications, with these trends: Potholes (+180%), Unshoveled Sidewalks (+114%), Trash/Recycling (+49.3%), Parks/Playgrounds (- 23.1%), and Grafitti (- 23.6%)

14. The least reported problems were 44 abandoned bikes and 64 broken parking meters. (p. 60)

15. During PRIDE month, over 21 crosswalks and one sidewalk were painted in the colors of the diversity PRIDE flag.

16. The Transportation Department manages over 485 off-street overnight parking spaces in 11 locations, and issues 860 daytime parking permits to school teachers and staff, and issues 319 hangtags for use by local business employees in Brookline Village and Coolidge Corner.

17. The Highway Dept. disposed of 1393 tons of leaves and 5005 tons of street sweeping debris.

18. Sidewalk replacement in 2022 was minimal due to lack of staffing — a mere 14 cubic yards of concrete. The goal is to place 500-800 yards of concrete sidewalk per season.

19. The Parks and Open Space division manages 500 acres of public open space, on over 120 sites comprised of 38 parks and playgrounds, three sanctuaries, ten public school grounds, the land around 15 public buildings, five public parking areas, two cemeteries, over 60 traffic circles, islands, and open space, and over 50,000 trees including 12,000 public street trees.

20. A total of 1300 residents and 191 non-residents enrolled in the Green Dog off-leash program at 14 Green Dog sites.

I’ve worked my way through a mere half of the full 2022 Annual Report. There’s much more to be learned. Check out the report.

All Politics is Local: May 26 - June 2

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

One School Committee meeting, two big issues

If the folks at the newly-launched www.brookline.news want a tip on local coverage from a veteran of the vanished weekly newspaper trade, here it is: for starters, sit in on meetings of the Select Board and School Committee. The proceedings can be long and tedious, but now and then news happens in plain sight.

As an example, there’s the May 18 meeting of the School Committee. What played out during the public comment portion was newsworthy on two fronts: the threat of gun violence, and a double-barrelled warning of labor unrest.

I’ve transcribed key segments of presentations made to the nine members of the School Committee, who listened respectfully, but didn’t respond because that’s the governing policy for “items not on the agenda” arising during public comment.

1. Gun Violence

The first two speakers were students speaking openly about trauma caused by a recent incident at the high school.

I’m using just their first names. Zoe, a senior, spoke first. This is a partial transcript:

Zoe —

“On May 3rd at 8:20 in the morning, a student at BHS brought a BB gun to school and showed it off to their friends. At 10:45, the administration was notified of a possible firearm in the school and the student was searched. After the student fled the premises local police were notified and the student was arrested on Davis Avenue. Students and families were notified about the specifics at 6:38 p.m. through a mass email.

“Gun violence runs rampant in this country and we believe our school is ill equipped to deal with this issue. Even though the weapon was presumed to be an actual gun, there was no lockdown and the Brookline Police Department was not called until after the student fled school grounds.

“I believe that this response was insufficient and that undue fear was spread due to poor communication on behalf of the administration. I was in the middle of science class when I heard an ambiguous announcement over the loudspeaker stating that an incident had occurred. Confused, I asked what happened and my peer whispered over to me: ‘a gun.’ My heart dropped. I frantically texted my brother who is a freshman, asking if he was okay. I truly felt scared for him and myself.

“Even after it was revealed to be a BB gun, I felt uneasy. I don’t feel safe going to school and neither does much of the student body.

“We live in a reality where, in addition to school work, students have to learn how to survive. During class, my 14-year-old brother thinks about how he would jump onto a ledge from his fourth floor classroom to escape if there was a shooter. A school made of glass may look pretty but when it’s the only barrier between you and an armed invader.pretty is not enough. The school is currently failing at its most important job – keeping us safe.”

Chloe, also a senior, then spoke:

Chloe —

“We would like the School Committee to recognize the severity of this issue. One action would be to ensure the administration issues school ID’s to students that unlock doors.

“Currently Brookline High School is completely open, and most doors are unlocked throughout the day. This makes it easy for anybody to enter the building undetected. At the beginning of the school year we were promised school ID’s and locked doors, but never received either. We want the schools to follow through on their promises and to take this critical step to keeping our school safe.

“The open campus policy for students can co-exist with measures that keep those inside the buildings safe…

“Another course of action would be for the School Committee to ensure that the Restorative Justice policy is followed and more preventive measures are taken. We are especially interested in taking a restorative approach in ensuring that students who are struggling are given the proper resources.

“When school shootings occur in the U.S., people talk about the warning signs. In most incidents, including this one, there are warning signs. But the administration does not take them seriously. From Tik Tok trends about School Shooting Day and fights right inside our halls, these signs are brushed aside.

“Warnings signs like these need to be taken seriously by the administration. And students who harm or threaten to harm others in school should be given the help they need. And the school must ensure that they cannot harm anyone else.

“This is not about the student who brought a BB gun to school. This is about the overall safety of students and the lack of preventative measures taken by the administration. I worry about what happens if someone brings a real gun to school with the intention to cause harm.

“Just because we live in Brookline does not mean we are exempt from real world problems. The over 2,000 students who roam these halls plus the teachers, coaches and administrators would all feel safer if we had a comprehensive course of action to protect our community.”

Footnote to the above:

Whether in schools or wherever people gather, the threat of gun violence isn’t just a public safety issue. It also impacts the Town’s ability to balance budgets. The Select Board will soon present to Town Meeting labor contracts negotiated with public safety unions (Police and Fire). The Fire contract contains an added sum of several hundreds of thousands of dollars for so-called Active Shooter/Hostile Event (ASHER) training. You can read more about ASHER training in this release from MA Office of Public Safety. From the release: “FBI data indicates that the US has experienced over 370 active shooter incidents in the last twenty years. These incidents have resulted in nearly 3,000 casualties, claiming the lives of 1,100 victims, including the death of approximately 100 members of law enforcement.”

Note: An earlier version of the above paragraphed incorrectly referenced the cost of the ASHER part of the contract with Firefighters. The final figures for both ASHER and the total contract cost will be presented for approval by Town Meeting.

2. Labor Unrest

The greater part of the public comment period was dominated by a sometimes raucous parade of presentations by members of the Brookline Educators’ Union (BEU).

Although voters on May 2 approved an additional $6.98 million to fund school operations, the unionized teachers highlighted complaints stemming from budget tightening in FY24. World Language teachers took turns reading a jointly-signed letter:

Laura Brady (grade 5/6 Spanish teacher at Heath and Runkle) —

“Currently, too many K-8 World Language Program educators are given excessively high student loads and untenable scheduling involving erratic teaching locations, no limit to the number of grade levels taught, and no limit to the number of sections. Furthermore they’re typically excluded from team meetings due to scheduling.

“In 2015, the Brookline voters approved a tax hike to speciically support the K-8 World Language program, whereas today, these dedicated educators face precarious employment and are frequently threatened with layoffs. Over the past five years, more than a dozen K-8 World Language educators — over half in the program — have left the Brookline School District.

“The BEU sees this as a failure on the part of the District to support important programs with the racially and ethnically diverse staff that promotes respect for diverse cultures and knowledge about the world beyond the Town borders.

“Allowing further weakening of the K-8 World Language program would be a devastating blow to Brookline’s attempt to be a more culturally responsive school district for students and staff alike.

“For these reasons, the BEU is asking for immediate action on the part of the School Committee to reach an agreement that protects the K-8 World Language program.”

Other issues cited by the teachers:

an ARPA-funded premium pay policy that rewarded some teachers, but left out others, who taught during COVID;

also, “poverty wages” for paraprofessionals;

and then there was this argument that the recent $6.8 million override fell short in the view of literacy and math specialists:

Hillary Rosenzweig, math specialist at Lincoln (30+ years Brookline educator) —

“Despite the override, pre-determined significant cuts are being made within the literacy and math specialist departments. Our parent community needs to be aware of the deliberate choice to underfund literacy and math and not include us in the override.

“As math specialists, we are direct student-facing supports. We work with students who have challenges making effective math progress. We work with students to build their identity, agency and success with math, and to minimize the need for special education referral and evaluations.

“At Lincoln, we will drop from two fulltime specialists to one and a half. I am a .5 at Lincoln and .5 at another school now. This will be the lowest level of supports in 15 years — at a Title 1 school with some of the most at risk students.

“With a single uninformed decision, top leaders in our district have made a huge, detrimental mistake that will have large reprecussions for our students… The neediest students will be receiving substantially less services — ultimately, closing doors and opportunities.”

To experience the full flavor of the BEU’s message to the school committee, sample their impromptu union fight song led by incoming BEU President Justin Brown. It begins at 1:16:25 of the video.

Outgoing BEU President Jessica Shubow told me later that the May 18 showcase of BEU demands won’t be their last. Fasten your seat belts.

Looking Back at the May 2 Election

The incomparable Tom Elwertoski has a website where you can check out many visualizations of the results of the Tuesday, May 2 election. For example, take this one (showing highest turnout in precincts 6 and 16, and lowest in 4 and 2):

And there’s this map, showing a clear geographic divide between precincts heavily FOR and AGAINST Question 1, the Pierce debt exclusion. You can check out all the visualizations at Tom’s “About Brookline” website.

All Politics is Local: May 19 - May 26

by John VanScoyoc

Select Board

“You can observe a lot by just watching.” — Yogi Berra

Explaining the FY24 Budget in Seven Charts

It’s that time of year when, in the days before everything went digital, two documents would land with a thud (or thud, thud) on the doorstep of every one of the Town’s 250+ Town Meeting Members.

The first is the so-called Combined Reports on the articles in the Town Meeting Warrant, including Warrant Article 7, the FY24 budget. The second is the Financial Plan — a department by department, account by account, line item by line item detailing of the FY24 Budget, including both the operating departments and the immediate and long range expenditures on our buildings, roads, and all other basic infrastructure.

Both documents are intimidating and mystifying, even to those who have combed through them for many years. Should you wish to experience them yourself, you will find the Combined Reports here, and the FY24 Financial Plan here. Be warned: the Combined Reports numbers 294 pages, and the Financial Plan numbers 487 pages.

No one ever said serving as a volunteer Town Meeting Member would be easy.

In hopes of recapping the FY24 budget in terms that even I can understand, I’ve converted the essentials to seven charts. (You won’t find these anywhere in the documents themselves.) Here are the charts, with explanations for each.

1.

It helps to keep in mind that the operations of the Town and Public Schools provide us with the same basic services year after year: education, public safety, recreation, enrichment, transportation and essentials such as clean water and sanitation. The cost of all this is divided between “people” and “things.” The budget is roughly 80% people and 20% things. The people part is “operations.” The “things” part is supplies and minor and major infrastructure (roads, buildings, etc.).

And that’s the story behind Chart #1 (above). For the most part, the Big Ticket Items don’t change much. School operations consume the biggest part, followed by Town operations, followed by the benefits accrued by employees (pensions and retiree health care). Then comes paying off the debt accrued for “things” such as school projects. Then comes routine maintenance of all the infrastructure already in place.

Those 5 “big ticket” items consume 95% of the FY24 budget.

To the extent that the Schools share of the pie grows faster than the pie as a whole, the Town share will shrink. And vice versa. The same rule applies to other shares of the pie. Which brings us to Chart #2.

2.

Over the past ten years, both the Schools share and the Town share of total expenditures have decreased slightly. (Relative to the Town share, the School share has decreased less.) The Benefits share has stayed the same. Infrastructure has grown, but is still the smallest share. However, the “winner” in the budgetary pie-eating contest is the Cost of Borrowing — paying down interest and debt on major construction projects (mostly school buildings).

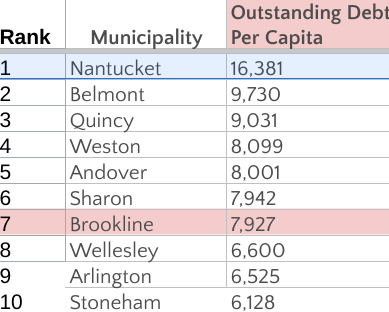

To put it in the simplest of terms: Big Borrowings have Big Impacts on budgets. Which is why fiscal policies are adopted with the goal of spreading the impact evenly over decades. One of those policies (I’m told it dates back to 2004) is to define a “ceiling” for borrowings based on the impact on taxpayers. Which brings us to Chart # 3.

3.

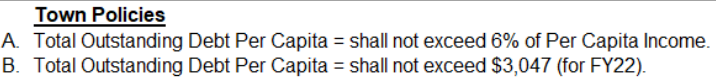

If you scroll to page 368 of the FY24 Financial Plan you will find a footnote summarizing several fiscal policies of the Town, including these two:

Both policies were observed consistently until FY17. However, as you can see in the chart, things then changed dramatically, with the result that the Town debt per capita is now nearly 3x the “shall not exceed” ceiling in the Town’s fiscal policies.

To date, this departure from fiscal policies has not hindered the Town from maintaining its AAA bond rating, which helps to keep borrowing costs in check. Is the policy unrealistic? Or is the spike in borrowing a cause for concern? Neither question is addressed in the FY24 Financial Plan.

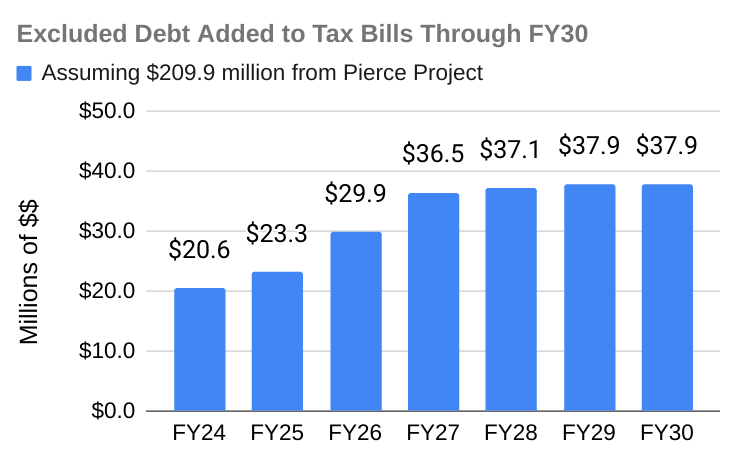

However, the pressure from debt repayments will continue to be felt in tax bills in the years ahead — and that much is clear from Chart #4.

4.

Given the amount of debt that will be required to finance future capital projects, Brookline is fortunate that the State-mandated 2.5% cap on increases in the annual tax levy comes with a “safety valve.” The Prop 2 1/2 law allows for both “budget overrides” and “debt exclusions” — both of which Brookline voters okayed in the May 2 election (Questions 1 and 2a on the ballot).

Which leads to Chart #5.

5.

One of the consistent features of Brookline’s budgets is that they are always “under the strain of Prop 2 1/2” (as people like to say), but revenues from property taxes actually increase by something like double the 2.5% “cap.” (In the FY24 budget, the increase in the property tax levy is actually 5.5%). This is a result of three factors:

“new growth” in the tax base, which tends to average the equivalent of 1+% of the levy;

the cumulative impact of Prop 2 1/2 overrides,

the temporary impact of paying down debt exclusions.

Finally, no overview of budget basics would be complete without mentioning the impact of increases in the number of personnel on Town and School payrolls.

6. and 7.